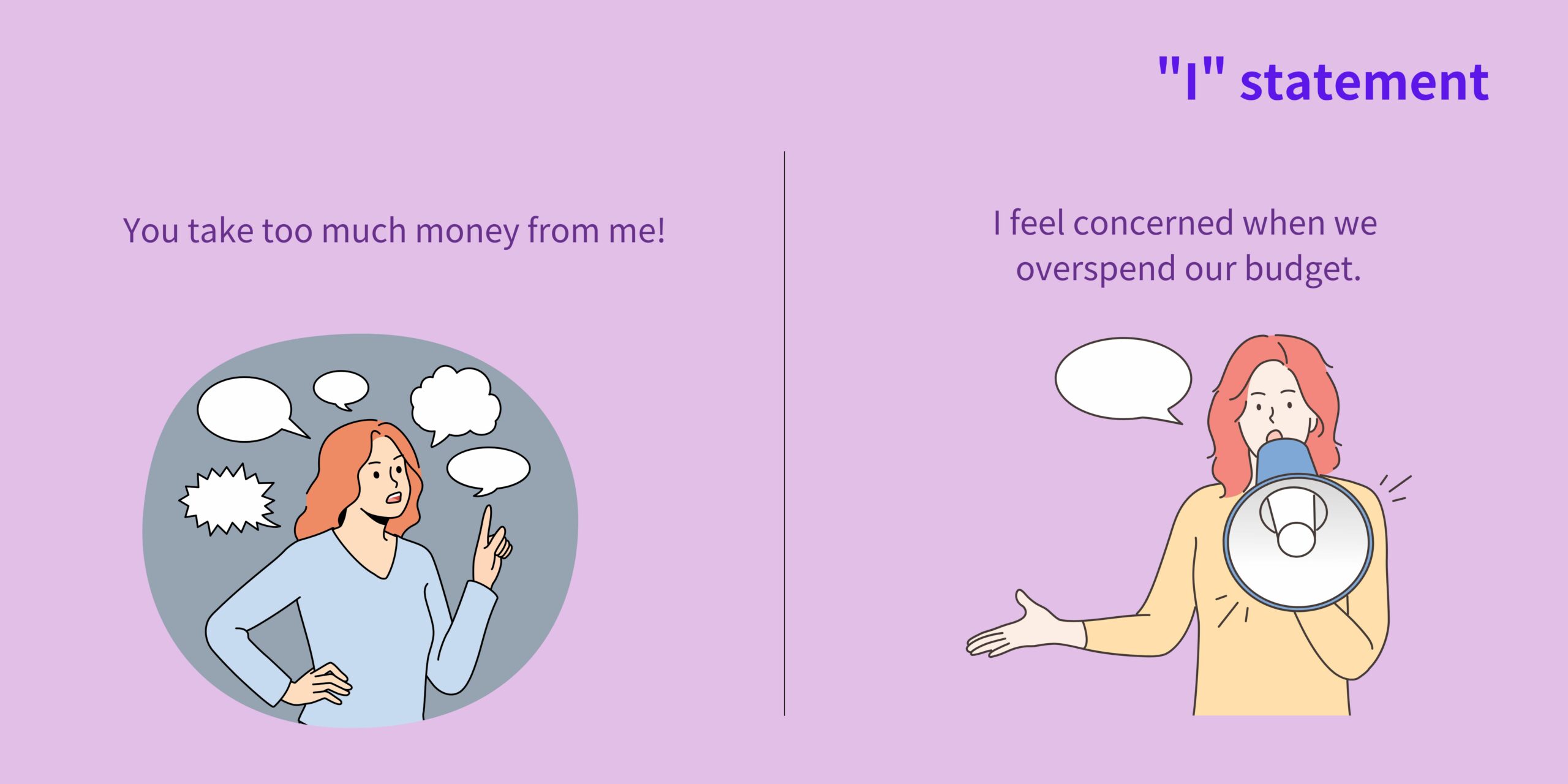

Setting firm boundaries is just as important as compromising, especially when your family’s expectations exceed what you can afford, hence it is helpful to communicate these boundaries clearly and assertively. For example, letting your family know that your money should be spent on their expenses and them lending it to other family friends is unwelcome. Be upfront with what you can help with and how far you can go and avoid getting into debt due to fulfilling unrealistic expectations. Setting clear financial boundaries was associated with higher levels of financial satisfaction and lower levels of financial conflict in couples, and the same applies for other familial relationships as well. Instead, you can offer to contribute non-monetary services, such as sending DIY handcrafts as a gift to a family celebration.

Talking about money and clarifying expectations with your family is difficult, but sometimes it is necessary. Remember that taking care of yourself emotionally and financially is important too!

References

Africa’s Pocket. (n.d.). How to manage your family’s financial expectations and still achieve your personal goals. https://africaspocket.com/our-blog/how-to-manage-your-familys-financial-expectations-and-still-achieve-your-personal-goals

Archuleta, K. L., et al. (2011). Financial communication, relationship satisfaction, and financial satisfaction. Journal of Financial Therapy, 2(1), 1-21.

Britt, S. L., et al. (2016). Examining the role of financial conflict in the relationship between financial satisfaction and marital satisfaction. Journal of Financial Therapy, 7(1), 1-22.

Gudmunson, C. G., & Danes, S. M. (2011). Family financial socialization: Theory and critical review. Journal of Family and Economic Issues, 32(4), 644-667.

Papp, L. M., et al. (2013). The interplay of division of labor, spouse support, and gender on housework stress. Journal of Family Issues, 34(8), 1070-1095.